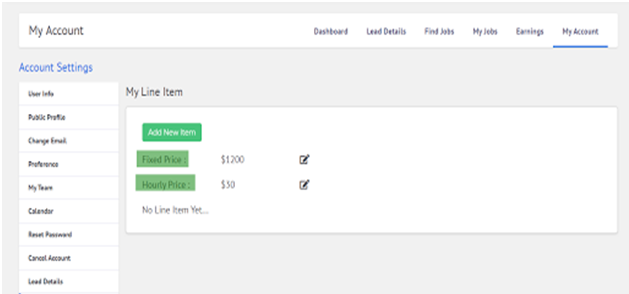

A unit of information in a document, record, or statement, shown on a separate line of its own. Line items often refer to a budget element that is separately identified.

Purpose

The line item budgeting system serves several purposes. First, it helps a business understand whether its income is sufficient to cover its expenses. Second, a line item budget makes it easy to verify when a single item exceeds the budget or comes in under budget. For example, if a company suspects that its materials costs are getting out of hand; it can specifically pay attention to this item and compare the variance over time. Finally, a line item budget helps finance managers obtain information about which detailed expenses roll up into each of the major functions of a business; this is important to determine if one department is performing worse financially than others.

From a technical standpoint, it’s easy to create a line-item budget. With a piece of lined paper and a pencil, you can list all expenses, giving each item its own line and specific dollar amount. This is why many organizations, especially very small businesses, choose line-item budgeting. It is straightforward and does not require linking budgeting to advanced accounting, such as activity-based costing, or management practices, such as performance-based budgeting.

Payment Items

The conditions under which a seller will complete a sale. Typically, these terms specify the period allowed to a buyer to pay off the amount due, and may demand cash in advance, cash on delivery, a deferred payment period of 30 days or more, or other similar provisions.

Fixed Price

A periodic cost that remains more or less unchanged irrespective of the output level or sales revenue, such as depreciation, insurance, interest, rent, salaries, and wages.

While in practice, all costs vary over time and no cost is a purely fixed cost, the concept of fixed costs is necessary in short term cost accounting. Organizations with high fixed costs are significantly different from those with high variable costs. This difference affects the financial structure of the organization as well as its pricing and profits. The breakeven point in such organizations (in comparison with high variable cost organizations) is typically at a much higher level of output, and their marginal profit (rate of contribution) is also much higher.

Hourly Price

1. Selling and general administrative expenses identified with the accounting period in which they are incurred, and charged against sales revenue in the same period.

2. Depreciation, interest, rent, and other such costs associated with the passage of time (instead of with the units of output) and treated as fixed costs.

Advantages

- A line item budget is easy to prepare and monitor.

- Each organizational unit itemizes its expenses and allocates a precise amount for each expense.

- It creates valuable statistical information that demonstrates trends and opportunities to save money.

- Line-item budgeting can give a large organization flexible use of budgetary control

Goals

The line item budget is a commonly used financial accounting technique used to forecast costs for expenditures that ideally support an organization’s strategic business goals and objectives. The aim of a budget is to directly match financial resources to action plans that further business objectives. As such, the line item budget might be viewed within organizations as a strategic planning tool.

Recent Comments